Mortgage Blog

Category: Mortgage (83 posts)

How to Find a Mortgage Broker in Bennington, Nebraska

February 10, 2026 | Posted by: Jack Shotbolt

Many people assume that you need a perfect credit score and a straightforward 9-to-5 job to qualify for a great mortgage. That’s simply not true. The reality is that everyone’s financial s ...

read moreChoosing a Mortgage Broker in Bellevue, NE: A Guide

February 9, 2026 | Posted by: Jack Shotbolt

Not everyone’s financial story fits into the neat little box that traditional banks prefer. If you’re self-employed, a first-time homebuyer, or have a few bumps in your credit history, you ...

read more5 Key Benefits of a Mortgage Broker Over a Bank

February 5, 2026 | Posted by: Jack Shotbolt

Think about the last time you made a big purchase. You probably shopped around, compared prices, and read reviews to make sure you got the best deal. So why wouldn't you do the same for the biggest pu ...

read moreJanuary 2024 Rate Update - Federal Reserve issues FOMC statement

January 30, 2026 | Posted by: Jack Shotbolt

Understanding the Federal Reserve’s (the "Fed") decisions is crucial for any homeowner or buyer in Omaha. While the Fed does not directly set mortgage rates, their monetary policy implementati ...

read moreShould You Spend the Full Mortgage Amount You're Approved For?

January 30, 2026 | Posted by: Jack Shotbolt

Before you start shopping for a new home, you'll need to know exactly how much house you can afford. Otherwise, you could end up in a home that is way out of your budget. What you qualify for may not ...

read moreRisks of Putting Down a Firm Offer with a Pre-Approval Omaha, Nebraska

January 30, 2026 | Posted by: Jack Shotbolt

Risks of Putting Down a Firm Offer with a Pre-Approval Today, the real estate market is competitive and homebuyers need all the help they can get to secure their home at the right price. Once you fin ...

read moreFirst-Time Home Buyer Budgeting: What You Need to Know about hard money loans in omaha nebraska

January 30, 2026 | Posted by: Jack Shotbolt

As a first-time home buyer, budgeting is an essential part of the home buying process. By carefully planning your finances and considering all of the costs associated with purchasing a home, you can e ...

read moreHow Much House Can I Afford? Home Budget Guide

January 30, 2026 | Posted by: Jack Shotbolt

Introduction Hey there! Have you ever wondered how much house you can afford? Well, it's an important question to ask before making any big decisions. In this article, we're going to dive into a simp ...

read moreImplementation Note issued March 16, 2022

January 30, 2026 | Posted by: Jack Shotbolt

Decisions Regarding Monetary Policy Implementation The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its ...

read moreUnlocking Financial Flexibility: The Benefits of a Cash-Out Refinance

January 30, 2026 | Posted by: Jack Shotbolt

Unlocking Financial Flexibility: The Benefits of a Cash-Out Refinance When managing your finances, leveraging the equity in your home can be a powerful strategy. One popular method for doing this is ...

read moreRate Hold - March 20, 2024

January 30, 2026 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year ...

read moreFed raises interest rates again, hints at smaller increases ahead

January 30, 2026 | Posted by: Jack Shotbolt

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting sup ...

read moreYour Guide to Refinance Mortgage Rates Today

January 29, 2026 | Posted by: Jack Shotbolt

While you can’t control the economy or predict exactly where refinance mortgage rates today will be next week, you have significant power over your own refinancing success. The strength of your ...

read moreHow to Get Pre-Approved for a Mortgage Loan: Step-by-Step Guide

January 27, 2026 | Posted by: Jack Shotbolt

In a busy housing market, making your offer stand out is everything. Sellers often receive multiple bids, and they’re looking for the one that is most likely to close without any financing hiccu ...

read moreHow to Use a Self Employed Mortgage Calculator

January 26, 2026 | Posted by: Jack Shotbolt

One of the biggest hurdles for self-employed home buyers is understanding how their income looks to a lender. The smart tax deductions that save you money can actually reduce the amount you qualify fo ...

read moreHow a Funding Condition Can Secure Purchasers from financial and legal penalities in Omaha nebraska

July 3, 2025 | Posted by: Jack Shotbolt

When you make a deal to buy a home, in addition to thinking about how much money to provide, you likewise need to think about any conditions that you want to include. Some common conditions deal with ...

read moreHow to Check Mortgage Rates Near Me and Secure the Best Offer

April 19, 2025 | Posted by: Jack Shotbolt

You want to get the best possible deal on your home loan, and finding competitive mortgage rates near me is your first step toward significant savings. Your location plays a key role in determining av ...

read moreEverything You Should Know About a Fixed Rate Mortgage in 2025

April 19, 2025 | Posted by: Jack Shotbolt

It's natural to feel overwhelmed when navigating the mortgage landscape in 2025, especially with all the different loan options available to you. If you're planning to buy a home or refinance your cur ...

read moreIs There a Fixed Rate Mortgage Near Me That Fits My Budget?

April 19, 2025 | Posted by: Jack Shotbolt

Many homebuyers like you are searching for stability in their housing payments, making a fixed rate mortgage near me a smart choice to explore. You might be wondering if there's an affordable option i ...

read moreIs an Adjustable Rate Mortgage in Omaha a Smart Move in 2025?

April 19, 2025 | Posted by: Jack Shotbolt

Omaha's real estate market continues to evolve, and you might be wondering if an adjustable rate mortgage could be your ticket to homeownership in 2025. As you explore your financing options, understa ...

read moreWhy a Fixed Rate Mortgage in Omaha May Be Your Safest Bet

April 19, 2025 | Posted by: Jack Shotbolt

Mortgage decisions can feel overwhelming, but finding the right option for your home financing doesn't have to be complicated. If you're looking to buy a home in Omaha's growing real estate market, a ...

read moreComparing the Best Mortgage Lenders Near Me: Who Comes Out on Top?

April 19, 2025 | Posted by: Jack Shotbolt

Whether you're a first-time homebuyer or looking to refinance, finding the right mortgage lender can save you thousands of dollars over your loan term. Your choice of lender affects not just your inte ...

read moreTop Mortgage Brokers in Omaha: What Sets Them Apart in 2025

April 19, 2025 | Posted by: Jack Shotbolt

Brokers in Omaha's dynamic real estate market are evolving to meet your changing needs in 2025. When you're ready to navigate the home buying process, finding the right mortgage broker can make all th ...

read moreHow to Find the Best Mortgage Brokers Near Me: A Homebuyer's Guide

April 19, 2025 | Posted by: Jack Shotbolt

It's exciting to start your journey toward homeownership, but finding the right mortgage broker can feel overwhelming. Your search for mortgage brokers near me is an crucial first step in making your ...

read moreReliable Mortgage Advisors Near Me - Expert Guidance for Home Financing

April 19, 2025 | Posted by: Jack Shotbolt

As you commence on your journey to find the perfect home, you need guidance on navigating the complex world of mortgage financing. You want to make informed decisions about your home loan, and that's ...

read moreQuick Mortgage Approvals in Omaha - How to Speed Up Your Home Loan Process

April 19, 2025 | Posted by: Jack Shotbolt

You're ready to buy your dream home in Omaha, and you want the process to be as smooth and fast as possible. You're probably wondering how to get quick mortgage approvals, and you're in the right plac ...

read moreThe Benefits of Working with Reliable Mortgage Advisors in Omaha

April 19, 2025 | Posted by: Jack Shotbolt

You're navigating the complex world of mortgages in Omaha, and your financial future is on the line. You need guidance from experts who know the landscape. Reliable mortgage advisors can help you make ...

read moreFinding Reliable Mortgage Advisors Near Me - Key Factors to Consider

April 19, 2025 | Posted by: Jack Shotbolt

As you search for a mortgage advisor, you want to find someone trustworthy to guide you through the process. You're looking for an expert who can help you make informed decisions about your home finan ...

read moreThe Role of Reliable Mortgage Advisors in Omaha’s Competitive Market

April 19, 2025 | Posted by: Jack Shotbolt

As you navigate Omaha's competitive housing market, you'll quickly realize that finding the right mortgage can be overwhelming. You're faced with numerous options and complex financial decisions that ...

read moreRefinancing Options in Omaha - When and How to Refinance Your Mortgage

April 19, 2025 | Posted by: Jack Shotbolt

Understanding Refinancing Options While exploring your refinancing options in Omaha, it's crucial to understand the different types of refinancing available to you. Refinancing can be a great way to ...

read moreMortgage Lenders in Omaha - Choosing the Right Partner for Your Home Loan

April 19, 2025 | Posted by: Jack Shotbolt

As you start your journey to find your dream home in Omaha, you'll need to find a reliable mortgage lender to help you achieve your goal. You're looking for a partner who understands your unique needs ...

read moreHow Mortgage Brokers in Omaha Help You Secure the Best Deals

April 19, 2025 | Posted by: Jack Shotbolt

You're looking for a mortgage in Omaha, and you want the best deal. Your search leads you to mortgage brokers, but you're not sure what they can do for you. They're the middlemen between you and lende ...

read moreImplementation Note issued June 15, 2022

April 19, 2025 | Posted by: Jack Shotbolt

Decisions Regarding Monetary Policy Implementation The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its ...

read moreImplementation Note issued January 26, 2022

April 19, 2025 | Posted by: Jack Shotbolt

Decisions Regarding Monetary Policy Implementation The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its ...

read moreUnderstanding Closing Costs When Buying a Home in Omaha, NE

April 12, 2025 | Posted by: Jack Shotbolt

Understanding Closing Costs: What They Are and What You'll Pay When you buy a house, your down payment isn't the only money you'll need at the closing table. Closing costs are additional expenses, se ...

read moreDenied a Mortgage in Omaha? Here’s What You Can Do

April 12, 2025 | Posted by: Jack Shotbolt

What to do if You Are Denied a Mortgage Main reasons Why your mortgage application is Denied and What to do If Mortgage lenders reject Yours Mortgage lenders often reject loan application requests f ...

read moreHow Mortgage Rates Affect Buying Power in Omaha

January 2, 2025 | Posted by: Jack Shotbolt

How Mortgage Rates Affect Buying Power? Do You Know How Your Mortgage Rate Affects Buying Power? To maximize your purchasing power, you should understand how interest rates impact your home buying p ...

read moreHow a Private Mortgage Differs from a Traditional Bank Mortgage in Omaha

January 2, 2025 | Posted by: Jack Shotbolt

Understanding the difference between private mortgages and traditional bank mortgages can help you make the best decision for financing a new home. Each option provides the money to secure real estate ...

read moreUnderstanding Title Insurance Costs in Omaha: A Beginner’s Guide

January 2, 2025 | Posted by: Jack Shotbolt

Embarking on the journey of purchasing a new home is thrilling, yet the financial commitment can be daunting. It's imperative for prospective homeowners to take preventive steps to ensure their financ ...

read moreShould You Pay Off Your Mortgage Early in Omaha?

December 30, 2024 | Posted by: Jack Shotbolt

It's a dream to be able to pay off your mortgage early, but is there a downside? While it sounds like a great idea, there are some factors to consider before doing so. This article will explore some o ...

read moreJune 14, 2023 - Federal Reserve Issues FOMC Statement for Omaha Buyers

December 18, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has continued to expand at a modest pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains el ...

read moreFederal Reserve Issues FOMC Statement

December 18, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the ...

read moreDecisions Regarding Monetary Policy Implementation Issued May 4, 2022 - Omaha Market Insights

December 18, 2024 | Posted by: Jack Shotbolt

Decisions Regarding Monetary Policy Implementation The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its s ...

read moreFederal Reserve Issues FOMC Statement - Omaha Homebuyer Impact

December 18, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains eleva ...

read moreSeptember 18, 2024 - Federal Reserve Announces Rate Drops: What It Means for Omaha

December 18, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further prog ...

read moreIs Now a Good Time to Refinance My Mortgage in Omaha with Lower Interest Rates?

December 18, 2024 | Posted by: Jack Shotbolt

With whispers of lower interest rates on the horizon, many homeowners ask the million-dollar question: Is now a good time to refinance my mortgage? The short answer is: It very well could be! But befo ...

read moreJune 12, 2024 - Federal Reserve Issues FOMC Statement for Omaha Homebuyers

December 18, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past ...

read moreHow Interest Rates Affect Housing Markets in Omaha and Beyond

December 18, 2024 | Posted by: Jack Shotbolt

Suppose you've been watching the news or talking to friends about the housing market. In that case, you've probably heard about rising interest rates. But what does that actually mean for you? Let's b ...

read moreFHA Home Loans in Omaha: 7 Things You Need to Know Before Applying

December 18, 2024 | Posted by: Jack Shotbolt

If you're considering purchasing a home but feel uncertain whether you'll qualify for a traditional loan, an FHA loan could be a great option. Here are seven key things you need to know before applyin ...

read more7 Things to Know When Purchasing a Cottage or Vacation Home Near Omaha

December 18, 2024 | Posted by: Jack Shotbolt

Purchasing a cottage or vacation home can be a dream come true, offering a serene retreat from everyday life. However, it's essential to approach this investment with careful planning and knowledge. H ...

read moreUnderstanding Your Mortgage Payment in Omaha: A Beginner’s Guide

December 18, 2024 | Posted by: Jack Shotbolt

Navigating the world of home financing can be overwhelming for first-time homebuyers. One of the most critical aspects to understand is your mortgage payment. Breaking down the main items of a mortgag ...

read moreWhat Lower Interest Rates Mean for New Homebuyers in Omaha

December 18, 2024 | Posted by: Jack Shotbolt

If you're in the market to buy a new home, you've probably noticed that interest rates might soon be dropping. You might be wondering, 'What does this mean for me?' The good news is that lower interes ...

read moreDoes a Mortgage Refinance Require an Appraisal?

June 4, 2024 | Posted by: Jack Shotbolt

When considering refinancing your mortgage, many questions arise, and one of the most common is whether an appraisal is necessary. Understanding the role of an appraisal in the refinancing process c ...

read moreUnderstanding FHA Loans: A Guide for Homebuyers

May 8, 2024 | Posted by: Jack Shotbolt

As a mortgage professional, I've guided many clients through obtaining a home loan. One of the most popular options for first-time homebuyers and those with less-than-perfect credit is available ...

read moreMay 1-2024 - Federal Reserve issues FOMC statement

May 1, 2024 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past ...

read moreRefinancing to a 15-year mortgage: Items to consider

April 24, 2024 | Posted by: Jack Shotbolt

Refinancing to a 15-year mortgage can be a beneficial decision for homeowners. It can help you pay off your mortgage faster and save money on interest payments in the long run. However, there are se ...

read moreNavigating Your First Home Purchase: A Step-by-Step Mortgage Guide

April 8, 2024 | Posted by: Jack Shotbolt

Hey there, future homeowners! Embarking on the journey to buy your first home is like setting sail on an epic adventure. It's thrilling, a bit overwhelming, and packed with moments that'll have you ri ...

read moreWhen Steady Interest Rates Meet Rising Home Sales

February 28, 2024 | Posted by: Jack Shotbolt

In the ever-evolving landscape of the American housing market, we find ourselves at a crossroads where interest rates are holding steady, yet home sales are on an upward trajectory. This scenario ...

read moreUsing Home Equity Loans to Pay Off High-Interest Debt: Should You Do It?

February 19, 2024 | Posted by: Jack Shotbolt

Are you considering the leap to use a home equity loan to pay off high-interest debt? The allure is evident - with typically lower fixed interest rates than credit cards, these loans offer potential s ...

read moreDecember 2023 Rate Update - Federal Reserve issues FOMC statement

December 13, 2023 | Posted by: Jack Shotbolt

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemp ...

read moreNavigating the New Normal: How Remote Work is Reshaping the US Mortgage and Real Estate Landscape

December 3, 2023 | Posted by: Jack Shotbolt

In recent years, we've witnessed a seismic shift in our work lives, notably the rise of remote work catalyzed by the COVID-19 pandemic. This change isn't just about swapping office desks for dinin ...

read moreUnlock Your Home’s Potential: Using Home Equity for Renovations

November 15, 2023 | Posted by: Jack Shotbolt

What is home equity? Imagine your home is a piggy bank, except instead of spare change, it's filled with the value you've built up over time. Home equity is the difference between your home's market ...

read moreFederal Reserve issues FOMC statement - Nov 1, 2023

November 1, 2023 | Posted by: Jack Shotbolt

Recent indicators suggest that economic activity expanded at a strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has rem ...

read moreMortgage Brokers vs. Direct Lenders: Why a Broker Might Be Your Best Choice

October 18, 2023 | Posted by: Jack Shotbolt

Mortgage Brokers vs. Direct Lenders: Why a Broker Might Be Your Best Choice Hi there, prospective homeowner! Dive into any mortgage conversation, and you'll hear the terms "mortgage brokers" an ...

read moreA Guide To First-Time Home Buyer Programs, Loans And Grants

September 30, 2023 | Posted by: Jack Shotbolt

Purchasing a home involves many considerations, and it's common for first-time buyers to have queries. You might be curious about tips for first-time homeowners, or how to secure assistance for down ...

read moreNavigating High-Interest Rates and Inflation: A Guide to Mortgage Management

August 5, 2023 | Posted by: Jack Shotbolt

Introduction As your trusted mortgage broker, I understand that the current economic backdrop in the USA is posing challenges for many homeowners. With interest rates and inflation on the rise, mee ...

read moreHow To Calculate Home Equity: A Step-By-Step Guide

July 10, 2023 | Posted by: Jack Shotbolt

How to Calculate Your Home Equity Understanding Home Equity Home equity represents the portion of your home's value that you truly own as a homeowner. Determining Your Home Equity ...

read moreDecisions Regarding Monetary Policy Implementation Issued March 22, 2023

March 22, 2023 | Posted by: Jack Shotbolt

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on March 22, 2023: • ...

read moreSelling Your Home in the Winter: How You Can Make the Most of It

March 5, 2023 | Posted by: Jack Shotbolt

Selling your home in the winter can be a challenging task, but it can also be an opportunity to stand out in a crowded market. With fewer houses on the market and motivated buyers who are eager to mov ...

read moreNew Home Sales Hit 10-Month High, Despite Some Regional Decline

February 27, 2023 | Posted by: Jack Shotbolt

New home sales edged a little further out of a lengthy slump in January, topping 600,000 units for the second straight month. The U.S. Census Bureau and the Department of Housing and Urban Development ...

read moreWeekly mortgage demand jumps 7% as interest rates drop to lowest level since September

February 27, 2023 | Posted by: Jack Shotbolt

Mortgage interest rates fell for the third straight week, while mortgage demand also rose again. Total application volume increased 7% last week compared with the previous week, according to the Mo ...

read moreBest Ways to Plan for Your Down Payment

October 19, 2022 | Posted by: Jack Shotbolt

Best Ways to Plan for Your Down Payment Do mortgages seem unaffordable? These tips will help you plan for your down payment so you can start talking to a private lender mortgage broker in no time. ...

read moreDecisions Regarding Monetary Policy Implementation Issued September 21, 2022

September 21, 2022 | Posted by: Jack Shotbolt

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on September 21, 2022: •& ...

read moreHow a Mortgage Pre-Approval Can Protect You from Rising Rates

May 26, 2022 | Posted by: Jack Shotbolt

With interest rates rising, it's important to lock in a lower rate as soon as possible. You can do this with the right home mortgage pre-approval. Find out how! Do you plan on searching for and buy ...

read moreTop 10 Questions to Ask Your Mortgage Broker in Omaha, Nebraska

January 19, 2022 | Posted by: Jack Shotbolt

Top 10 Questions to Ask Your Mortgage Broker The mortgage world can sometimes be difficult to navigate when buying a home. However, an experienced Mortgage Broker can help walk you through the proces ...

read moreHow Much of A Mortgage Can You Afford?

January 5, 2022 | Posted by: Jack Shotbolt

How Much of a Mortgage Can You Afford? Mortgage Application: How Much of A Mortgage Can You Afford? The mortgage application process involves a buyer's due diligence in calculating how much mortgage ...

read moreDecisions Regarding Monetary Policy Implementation issued December 15, 2021

December 15, 2021 | Posted by: Jack Shotbolt

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on December 15, 2021: • The Board of ...

read morePrequalification and Pre-Approval—What is the Difference? Home Buying in Omaha, Nebraska

December 15, 2021 | Posted by: Jack Shotbolt

What is the Difference Between Pre-Qualification and Pre-Approval? Prequalification and Pre-Approval-What is the Difference? Prequalification is a basic review of the borrower's information to deter ...

read moreHow to Know if it's Time to Refinance

November 3, 2021 | Posted by: Jack Shotbolt

How to Know if it's Time to Refinance According to mortgage advisors, mortgage refinancing is one of the ways to make and save money from your home loan. When done right mortgage refinancing benefits ...

read moreWhat Is Home Equity and How Can I Build It?

October 6, 2021 | Posted by: Jack Shotbolt

Home equity is an essential asset for creating wealth and income. Learn how home equity is calculated, why it's important, and five steps you can take to build it. As you make monthly mortgage paymen ...

read moreGetting a Mortgage as a Student

August 18, 2021 | Posted by: Jack Shotbolt

Purchasing a home is most likely one of the most sizable purchases most of us will ever make, and finally, buying a home is a dream come true for most. For students, it may seem like this dream is fo ...

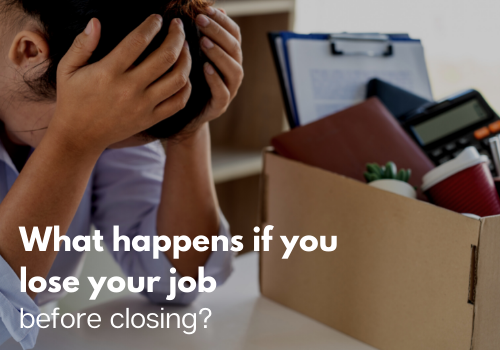

read moreWhat Happens if You Lose Your Job Before Closing?

August 4, 2021 | Posted by: Jack Shotbolt

A job loss a few days or weeks prior to closing your home purchase can be distressing; especially when you have no alternative source of income. Getting a new job can ease the situation, but it's not ...

read moreDecisions Regarding Monetary Policy Implementation issued July 28, 2021

July 28, 2021 | Posted by: Jack Shotbolt

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its • The Board of Governors of the Federal Reserve ...

read moreSee What Our Clients Are Saying

View All Testimonials Goodbye Paperwork.

Goodbye Paperwork.

Hello Quick Approval.

Save Your Time & Apply Online. Competitive Market Rates.

_988193.jpg)